A comprehensive guide to the fundamental principles of international trade law and how small businesses can navigate legal requirements for cross-border commerce.

The global marketplace offers tremendous opportunities for small businesses, but it also introduces complex legal considerations. International trade law encompasses the rules and regulations governing commerce between different countries, and understanding its fundamentals is essential for any small business looking to expand beyond domestic borders. This guide provides an overview of key international trade law concepts and practical considerations for small businesses engaging in global commerce.

Core Framework of International Trade Law

International trade law operates at multiple levels, creating a complex web of rules that businesses must navigate:

International Agreements and Organizations

At the highest level, international trade is governed by multilateral agreements and organizations:

- World Trade Organization (WTO): The principal international body governing trade between nations, establishing rules to reduce trade barriers and resolve disputes. Small businesses benefit from the predictability and fairness the WTO framework provides, even if they don't directly interact with it.

- Trade Agreements: Regional trade agreements like USMCA (formerly NAFTA), CPTPP, and bilateral agreements create additional rules that may offer preferential treatment for goods and services between member countries.

- International Chambers of Commerce (ICC): Though not a governmental body, the ICC develops widely used standards like Incoterms® that define responsibilities in international sales contracts.

National Laws and Regulations

Each country maintains its own trade regulations, creating a patchwork of requirements:

- Import/Export Controls: Restrictions on what can enter or leave a country, often focusing on sensitive goods like technology, chemicals, or agricultural products.

- Customs Laws: Rules governing the classification, valuation, and processing of goods crossing borders, determining applicable duties and taxes.

- Foreign Investment Laws: Regulations on establishing business presence in foreign markets, which may include ownership restrictions or approval requirements.

- Currency Exchange Controls: Rules governing the movement of money across borders, potentially affecting payment terms and repatriation of profits.

Key Legal Considerations for Small Business Exporters

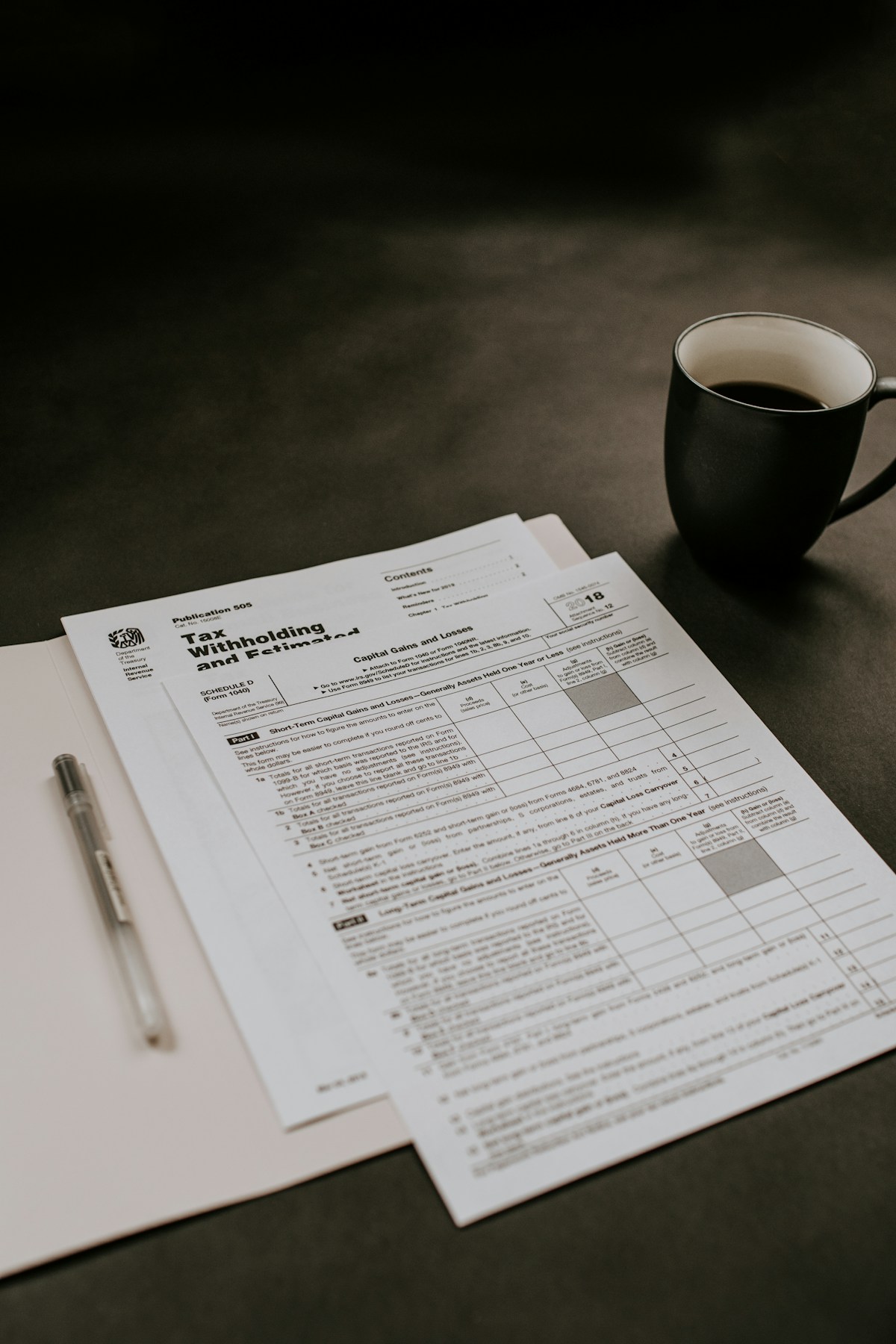

Tariffs and Duties

Tariffs remain one of the most direct impacts of trade law on small businesses:

- Classification: Products must be correctly classified under the Harmonized System (HS) code, which determines applicable duties. Misclassification can lead to unexpected costs or penalties.

- Country of Origin: Rules determining where a product is considered to have been made, which affects duty rates and eligibility for preferential treatment under trade agreements.

- Valuation: Methods for determining a product's value for customs purposes, which serves as the basis for calculating duties.

Compliance Requirements

Regulatory compliance is essential for sustainable international trade:

- Export Controls: Restrictions on sensitive goods, technologies, or exports to certain countries, often requiring licenses or permits.

- Import Licenses: Many countries require special permissions to import certain categories of goods.

- Technical Barriers: Product standards, certification requirements, and labeling rules that vary by country and can create significant compliance challenges.

- Sanitary and Phytosanitary Measures: Health and safety requirements particularly relevant for food, agricultural products, and cosmetics.

Intellectual Property Protection

Protecting your intellectual assets becomes more complex internationally:

- Territorial Nature: IP rights are generally territorial, requiring separate registrations in each market.

- International Treaties: Frameworks like the Madrid Protocol for trademarks or the Patent Cooperation Treaty can streamline multi-country protection.

- Enforcement Challenges: Widely varying enforcement mechanisms and effectiveness across different jurisdictions.

Practical Strategies for Small Businesses

Research Target Markets Thoroughly

Before entering a new market, understand its specific legal requirements:

- Consult government resources like the International Trade Administration or equivalent agencies in your country

- Work with local experts or distributors who understand market-specific regulations

- Research product-specific requirements, which may vary significantly across industries

Leverage Trade Agreements

Trade agreements can offer significant advantages:

- Determine if your products qualify for preferential treatment under applicable trade agreements

- Ensure you maintain proper documentation to substantiate claims for preferential treatment

- Consider trade agreements when selecting target markets for expansion

Implement Robust Compliance Processes

Compliance cannot be an afterthought in international trade:

- Develop documented procedures for trade compliance, including product classification and screening

- Train staff on compliance requirements and red flags

- Consider technology solutions to automate and streamline compliance processes

- Regular audits to ensure ongoing compliance as regulations change

Use International Commercial Terms (Incoterms®) Effectively

These standardized terms define responsibilities in international sales:

- Select appropriate Incoterms® that clearly allocate responsibilities for transport, insurance, and customs clearance

- Ensure terms are incorporated properly into contracts

- Consider how your chosen terms affect your costs and compliance obligations

Seek Professional Guidance

The complexity of international trade law often necessitates expert assistance:

- Customs brokers can help with classification and customs clearance

- Freight forwarders coordinate international logistics and often have compliance expertise

- International trade attorneys can provide guidance on complex regulatory issues

- Trade consultants may offer cost-effective assistance for specific markets or issues

While the legal landscape of international trade is complex, small businesses shouldn't be deterred from pursuing global opportunities. By understanding the fundamentals, researching target markets thoroughly, implementing sound compliance practices, and seeking expert guidance when needed, small businesses can navigate international trade law successfully and unlock the vast potential of global markets.