How to use debt collection laws to protect yourself from harassment and unfair practices.

When faced with aggressive debt collectors, understanding your legal rights and defense strategies can make a crucial difference in the outcome. Debt collection practices are regulated by federal and state laws that provide important protections for consumers. This guide reveals key legal strategies that can help you defend against debt collection actions.

Know Your Rights Under the Fair Debt Collection Practices Act (FDCPA)

The FDCPA is your first line of defense against abusive collection tactics. Under this federal law, debt collectors cannot:

- Call before 8 a.m. or after 9 p.m. without your permission

- Contact you at work if you've told them not to

- Harass you with repeated calls or use abusive language

- Make false statements or misrepresentations about the debt

- Threaten actions they cannot legally take or don't intend to take

- Contact third parties about your debt (except to locate you)

- Continue contact after receiving written notice to stop

Violations of the FDCPA can lead to the collector being liable for damages, and in some cases, dismissal of the debt.

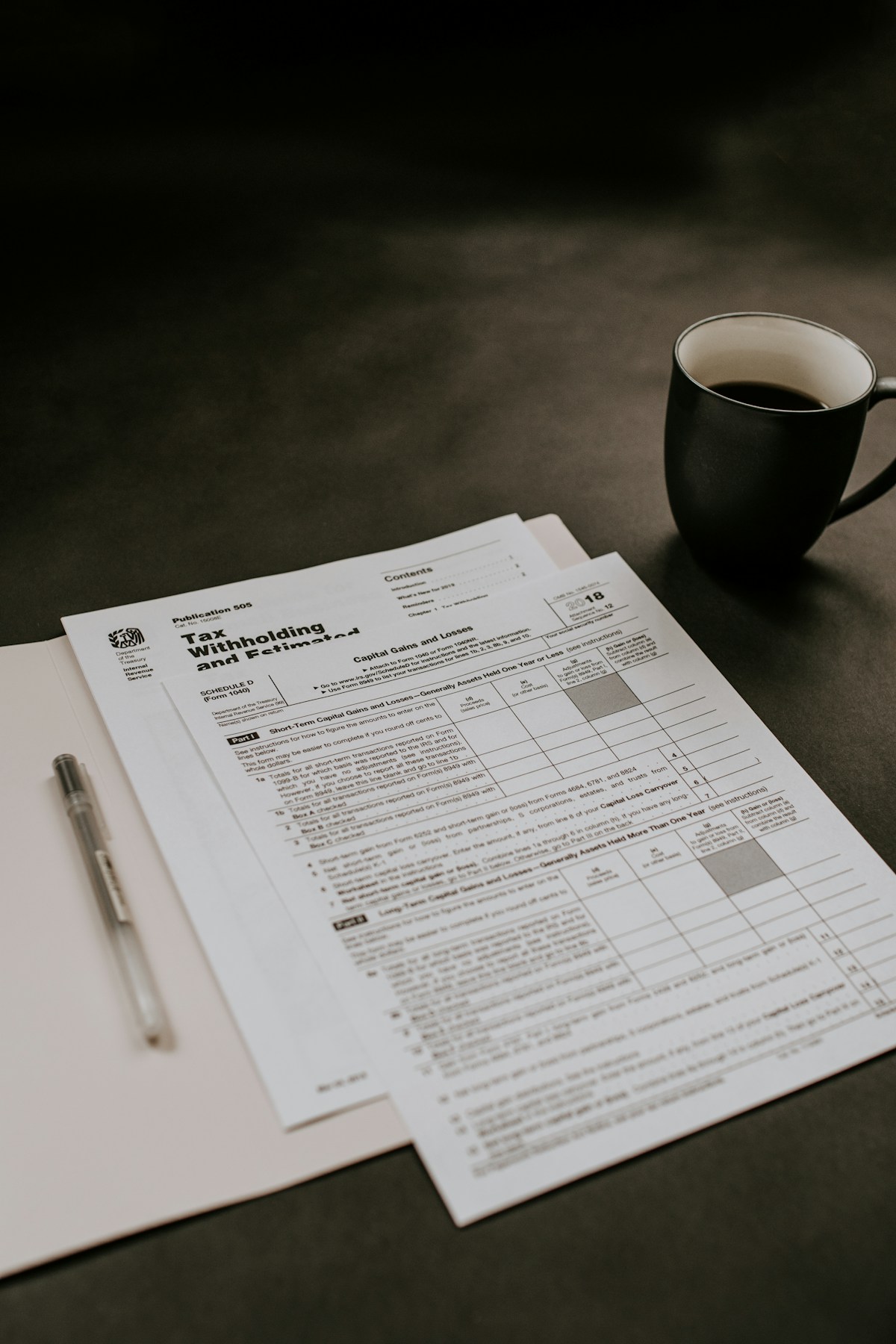

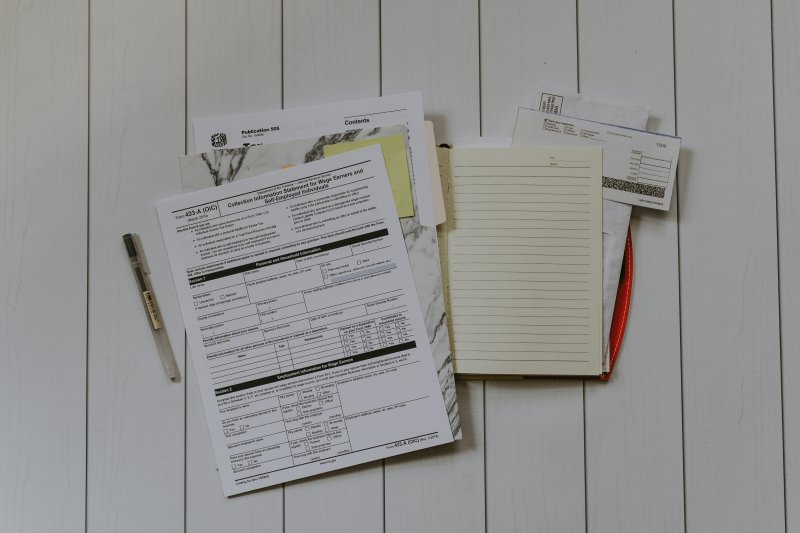

Demand Debt Validation

One of the most powerful yet underutilized protections is your right to demand validation of the debt. Within five days of first contacting you, a debt collector must send a written "validation notice" stating:

- The amount of the debt

- The name of the original creditor

- Your right to dispute the debt within 30 days

If you send a written dispute or request for verification within 30 days, the collector must cease collection activities until they provide verification of the debt. This simple step often reveals that the collector lacks proper documentation to prove their claim, especially with debts that have been sold multiple times.

Check the Statute of Limitations

Every debt has a "statute of limitations" – a time limit after which a creditor or collector cannot legally sue you to collect. These time limits vary by state and debt type, typically ranging from 3-10 years from the date of last activity on the account.

If the statute of limitations has expired on your debt:

- The collector can still attempt to collect, but cannot legally sue you

- If they do sue, you can raise the expired statute as an affirmative defense

- Be cautious about making payments or acknowledging the debt, as this can restart the clock in many states

Scrutinize Documentation in Lawsuits

If a debt collector sues you, they must prove their case with proper documentation. Many collection lawsuits are dismissed because the plaintiff cannot produce:

- The original credit agreement with your signature

- Complete records showing the chain of ownership if the debt has been sold

- Detailed accounting of the principal, interest, and fees claimed

Always respond to a lawsuit, even if you believe you owe the debt. Failure to respond typically results in a default judgment against you, which can lead to wage garnishment or bank account seizure.

Challenge Standing in Court

Debt buyers (companies that purchase delinquent debts from original creditors) often lack proper standing to sue. To have standing, they must prove:

- The debt was validly assigned to them

- They own the specific debt they're suing on (not just a portfolio containing it)

- The chain of assignments is complete and documented

Request through discovery the complete chain of title for the debt, including all purchase and sale agreements. Often, these documents contain language that undermines the debt buyer's claim to ownership.

Look for Procedural Violations

Collection lawsuits must follow strict procedural rules. Common procedural defenses include:

- Improper service - If you weren't properly served with the lawsuit papers

- Venue violations - If the case was filed in the wrong court jurisdiction

- Unauthorized practice of law - If non-attorneys are making legal judgments in the case

- Lack of proof of ownership - If the plaintiff cannot prove they own the debt

Consider Bankruptcy as a Strategic Option

While bankruptcy should never be taken lightly, it can be a strategic option in certain circumstances:

- Chapter 7 can discharge most unsecured debts completely

- Chapter 13 allows for structured repayment plans

- The "automatic stay" halts all collection actions immediately

- Even the threat of bankruptcy can sometimes bring collectors to the negotiating table

Document Everything

Create a detailed record of all interactions with debt collectors:

- Record dates, times, and content of all calls (where legal)

- Save all written communications

- Document any harassing behavior or potential FDCPA violations

- Send all communications via certified mail with return receipt

This documentation can be invaluable if you need to file an FDCPA complaint or defend yourself in court.

Consider Professional Help When Needed

While many debt collection defenses can be implemented without an attorney, consider professional help if:

- You've been served with a lawsuit

- The debt amount is substantial

- You're experiencing severe harassment

- You believe your consumer rights have been violated

Resources for low-cost legal assistance include:

- Legal Aid organizations

- Pro bono attorney programs

- Law school legal clinics

- Consumer advocacy organizations

Understanding your rights and using these defensive strategies can dramatically change the power dynamic between you and debt collectors. Remember that many collection attempts rely on consumers' lack of knowledge about their legal protections. By asserting your rights and demanding proper documentation, you can often achieve a better outcome than simply accepting a collector's claims at face value.