Essential legal considerations for the remote workplace, from data security to labor law compliance.

The dramatic shift toward remote work has fundamentally transformed traditional workplace dynamics, creating a host of complex legal questions for both employers and employees. As organizations embrace remote and hybrid arrangements permanently, understanding the evolving legal landscape has become essential. This comprehensive guide explores the key legal considerations that affect remote work relationships and provides practical guidance on navigating these challenges effectively.

Employment Classification and Remote Workers

Remote work arrangements can sometimes blur the lines between employee and independent contractor classifications—a distinction with profound legal implications.

Employee vs. Independent Contractor Status

Remote workers may be classified as either employees or independent contractors, but employers must be careful not to misclassify workers simply because they work remotely. The classification affects:

- Tax obligations – Employers must withhold income taxes, Social Security, and Medicare from employees but not from independent contractors

- Benefits eligibility – Employees are typically entitled to benefits like health insurance, retirement plans, and paid time off

- Wage and hour protections – Employees are covered by minimum wage, overtime, and other wage-hour laws

- Workers' compensation – Employees are generally covered by workers' compensation for job-related injuries

- Unemployment insurance – Employees can usually collect unemployment benefits when laid off

The determination depends on factors like control over work methods, permanency of the relationship, and integration into the business operations—not simply on location. Courts and regulatory agencies will look at the actual working relationship, not just what's stated in a contract.

Multi-State Employment Considerations

Remote work often means employees live in different states than their employers, creating complex multi-state compliance issues:

- State income tax withholding – Employers may need to withhold income taxes for the state where the employee works, not where the company is headquartered

- Unemployment insurance – Companies may need to register and pay unemployment taxes in each state where they have remote employees

- Workers' compensation – Coverage requirements vary by state, and employers must ensure compliance with the laws of each state where they have remote workers

Employers with remote workers in multiple states must be vigilant about tracking employee locations and understanding the compliance requirements for each jurisdiction.

Wage and Hour Compliance for Remote Workers

Remote work presents unique challenges for complying with wage and hour laws, particularly regarding tracking work time and compensating non-exempt employees properly.

Tracking Remote Work Hours

For non-exempt employees who are entitled to overtime under the Fair Labor Standards Act (FLSA) and state laws, employers must:

- Implement reliable systems for tracking all hours worked, including:

- Electronic time-tracking software

- Clear policies for recording start and end times

- Procedures for reporting technical issues that affect work time

- Establish clear policies about:

- Scheduled work hours

- Break times

- Overtime authorization requirements

- Reporting unauthorized work time

Employers should have remote workers acknowledge time-tracking policies in writing and provide regular training on proper time-keeping procedures.

"Off-the-Clock" Work Challenges

Remote environments make it more difficult to prevent "off-the-clock" work, which can lead to wage and hour violations. Key risk areas include:

- After-hours communications – Responding to emails or messages outside scheduled work hours

- System startup/shutdown time – Time spent logging into systems or shutting down equipment

- Technical difficulties – Time spent resolving technical issues affecting work

- Transition time – Brief periods between scheduled tasks or meetings

To mitigate these risks, employers should consider:

- Implementing technology that limits access to work systems outside scheduled hours

- Creating clear policies about responding to communications after hours

- Training managers to avoid assigning work or expecting responses outside scheduled times

- Establishing procedures for reporting all work time, including unexpected or brief work periods

Workplace Safety and Workers' Compensation

Employers maintain responsibility for providing safe work environments even when employees work remotely, creating unique challenges and legal obligations.

Home Office Safety Considerations

While employers cannot control an employee's home environment, they still have certain obligations regarding workplace safety:

- OSHA generally does not conduct home office inspections but may hold employers liable for hazards caused by materials or equipment provided to employees

- Employers should provide guidance on:

- Ergonomic workstation setup

- Fire safety measures

- Trip and fall prevention

- Electrical safety for work equipment

- Some employers choose to conduct virtual safety assessments or provide safety checklists for employees to self-evaluate their home workspace

Workers' Compensation for Remote Injuries

Workers' compensation coverage extends to remote employees, but determining whether an injury is work-related becomes more challenging:

- The injury must generally occur while the employee is performing work duties, not personal activities

- The "personal comfort doctrine" may apply to brief personal activities (like bathroom breaks)

- Courts typically evaluate whether the employer benefited from the activity during which the injury occurred

Employers should:

- Define designated workspaces and working hours in remote work policies

- Establish procedures for promptly reporting workplace injuries

- Train managers on handling remote work injury claims

- Verify workers' compensation policies cover remote workers in all relevant locations

Equipment, Expense Reimbursement, and Tax Implications

Remote work often requires employees to use personal resources for business purposes, raising questions about expense reimbursement and tax deductions.

Business Expense Reimbursement

Laws regarding employer reimbursement of remote work expenses vary significantly:

- Some states (California, Illinois, Massachusetts, Montana, New Hampshire, North Dakota, South Dakota, Iowa, and Pennsylvania) explicitly require employers to reimburse necessary business expenses

- Other states may require reimbursement if failure to do so would effectively reduce an employee's earnings below minimum wage

Common reimbursable remote work expenses include:

- Internet service (business portion)

- Personal cell phone usage for business

- Home office supplies

- Printing costs

- Required software or subscriptions

Best practices include:

- Creating a written expense reimbursement policy specifically for remote workers

- Establishing standardized stipends for predictable expenses

- Implementing a clear procedure for submitting expense reimbursement requests

- Considering state-specific requirements when developing policies

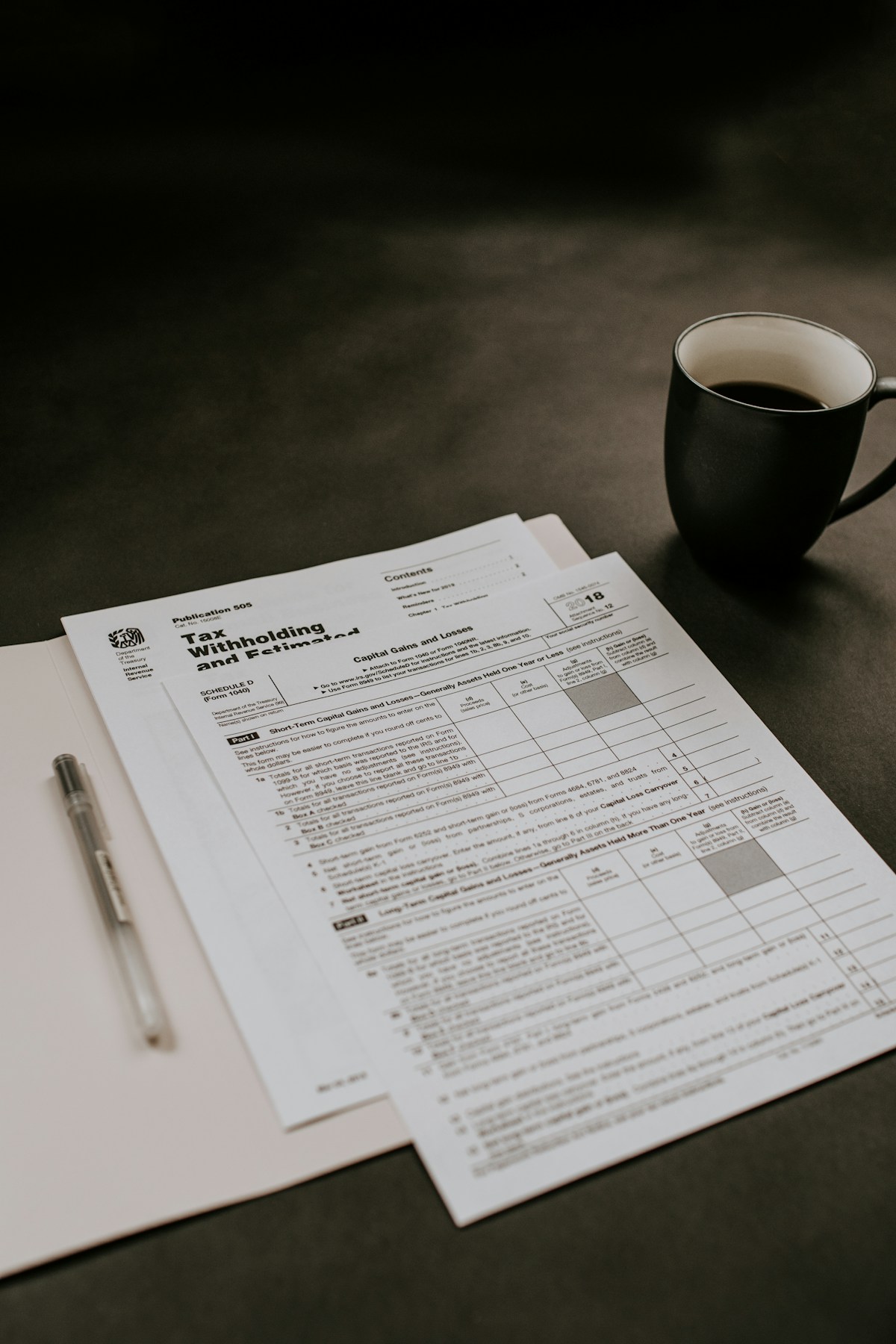

Tax Implications of Remote Work

Remote work arrangements create various tax considerations for both employers and employees:

- Employer considerations:

- Remote workers may create "nexus" (sufficient business presence) in new jurisdictions, potentially subjecting the company to additional state income taxes, sales taxes, or business registration requirements

- Multi-state payroll tax compliance becomes more complex

- Employee considerations:

- Remote workers may be subject to income tax in both their state of residence and the state where their employer is located (though credits for taxes paid often prevent double taxation)

- The home office tax deduction is generally unavailable to W-2 employees following the Tax Cuts and Jobs Act of 2017 (though it remains available for self-employed workers)

Privacy and Data Security

Remote work environments create heightened data security risks and unique privacy concerns as work activities occur in employees' homes.

Data Security Requirements

Employers must implement appropriate measures to protect sensitive information accessed by remote workers:

- Technical safeguards:

- Secure VPN connections for accessing company systems

- Multi-factor authentication

- Encryption for data in transit and at rest

- Automatic screen locking after periods of inactivity

- Regular security updates for all work devices

- Administrative controls:

- Clear policies regarding secure handling of confidential information

- Restrictions on using public Wi-Fi for work purposes

- Guidelines for secure disposal of physical documents

- Procedures for reporting potential data breaches

- Regular security awareness training tailored to remote work scenarios

Employers should also consider industry-specific compliance requirements such as HIPAA for healthcare information, GLBA for financial data, or GDPR and state privacy laws for consumer information.

Employee Monitoring and Privacy Boundaries

While employers have legitimate interests in monitoring work performance and ensuring appropriate use of company resources, remote worker monitoring raises significant privacy concerns:

- Legal considerations:

- Some states (including Connecticut, Delaware, and New York) require employers to provide written notice of electronic monitoring

- Wiretapping and electronic communications laws may limit certain types of monitoring without consent

- International privacy laws like GDPR impose strict limitations on employee monitoring

- Types of monitoring technologies:

- Software that tracks active work time and idle time

- Computer activity monitoring (keystrokes, websites visited, applications used)

- Regular screenshots or webcam access

- Email and chat message review

Best practices for balancing business needs with privacy concerns include:

- Providing transparent notice about all monitoring activities

- Obtaining explicit acknowledgment of monitoring policies

- Focusing on measuring productivity through output rather than activity

- Avoiding monitoring during off-hours or of personal devices

- Limiting monitoring to the minimum necessary for legitimate business purposes

Discrimination and Accommodation Issues

Remote work arrangements intersect with anti-discrimination laws and reasonable accommodation obligations in complex ways.

Remote Work as a Reasonable Accommodation

The Americans with Disabilities Act (ADA) and similar state laws require employers to provide reasonable accommodations to qualified individuals with disabilities:

- Remote work may constitute a reasonable accommodation for certain disabilities

- Courts have increasingly recognized telework as a potential accommodation, particularly since the pandemic demonstrated its feasibility for many positions

- Employers must engage in an interactive process to determine if remote work is a reasonable accommodation, considering:

- The essential functions of the position

- Whether these functions can be performed remotely

- The specific limitations caused by the disability

- Alternative accommodations that might be effective

Employers who permitted widespread remote work during the pandemic may face greater challenges in arguing that on-site presence is an essential job function, though this remains a fact-specific determination.

Preventing Discrimination in Remote Work Policies

Remote work policies must be developed and implemented in ways that avoid discriminatory impacts:

- Policy development considerations:

- Establish clear, objective eligibility criteria based on job functions

- Avoid criteria that could disproportionately impact protected groups

- Create consistent procedures for requesting remote work arrangements

- Document business justifications for positions deemed ineligible for remote work

- Potential discrimination risks:

- Offering remote work options disproportionately to certain groups (e.g., allowing more flexibility for younger workers while requiring older workers to be on-site)

- Performance evaluation bias against remote workers

- Promotion disparities between remote and on-site staff

- "Out of sight, out of mind" effects that can limit opportunities for remote workers

To mitigate these risks, employers should:

- Provide manager training on avoiding bias in supervising remote workers

- Establish objective performance metrics that apply equally to remote and on-site staff

- Create structured opportunities for remote workers to participate in meetings and projects

- Regularly review advancement patterns to identify potential disparities

International Remote Work Considerations

When remote employees work from foreign countries, employers face a highly complex set of legal challenges:

Employment Law Compliance

- Local employment laws typically apply based on where the employee physically works, not where the employer is located

- Critical compliance areas include:

- Minimum wage and overtime requirements

- Mandatory benefits (which may be more extensive than in the U.S.)

- Termination protections (many countries prohibit at-will employment)

- Working time regulations (including required rest periods)

- Paid time off entitlements

Immigration and Work Authorization

- Employees typically need proper work authorization in the country where they physically work

- Working on a tourist visa or visa waiver is generally prohibited

- Some countries have created "digital nomad" visas specifically for remote workers

- The legal distinction between "working in a country" versus "working while visiting a country" remains unclear in many jurisdictions

Tax and Corporate Presence Issues

- Remote workers may create a "permanent establishment" in foreign jurisdictions, potentially subjecting the company to foreign corporate taxation

- Employers may need to register with local tax authorities and withhold local taxes

- Social security/social insurance obligations may apply in multiple countries

Due to these complexities, companies allowing international remote work should:

- Develop clear policies about international work arrangements

- Consider using a Professional Employer Organization (PEO) or Employer of Record (EOR) in countries where they lack a legal entity

- Establish maximum durations for temporary work from foreign locations

- Consult with international employment law specialists before approving long-term international arrangements

Best Practices for Remote Work Policies

Comprehensive remote work policies help establish clear expectations and mitigate legal risks. An effective policy should address:

Core Policy Elements

- Eligibility criteria – Which positions qualify for remote work and why

- Work schedule expectations – Required hours, availability, and time-tracking procedures

- Communication requirements – Response time expectations and preferred communication channels

- Performance standards – How productivity will be measured and evaluated

- Equipment and technology – What the company provides versus employee responsibilities

- Expense reimbursement procedures – How to submit expenses and what qualifies for reimbursement

- Data security requirements – Security protocols for handling sensitive information

- Home office setup – Safety guidelines and ergonomic recommendations

- Geographic limitations – Approved work locations and procedures for requesting location changes

All remote work policies should be clearly communicated, consistently applied, and regularly reviewed to ensure continued legal compliance as laws evolve and workplace practices change.

While remote work offers tremendous benefits for both employers and employees, it also creates novel legal challenges. By proactively addressing these issues through well-crafted policies and practices, organizations can minimize legal exposure while maximizing the advantages of flexible work arrangements.