Essential legal guidance for cryptocurrency investors to navigate this complex regulatory landscape.

The cryptocurrency market has evolved from a niche interest to a significant asset class drawing attention from both individual and institutional investors. However, the regulatory landscape surrounding cryptocurrencies remains complex and constantly evolving. This guide outlines key legal considerations every cryptocurrency investor should understand.

Regulatory Status and Classification

The legal status of cryptocurrencies varies significantly across jurisdictions:

- Securities vs. Commodities: In the United States, the SEC generally views most cryptocurrencies and tokens as securities, especially if they pass the "Howey Test." Bitcoin and Ethereum are notable exceptions, categorized as commodities by the CFTC.

- Registration Requirements: When tokens qualify as securities, issuers may need to register offerings with securities regulators or qualify for exemptions.

- Legal Tender Status: Only a few countries like El Salvador have adopted cryptocurrency as legal tender. Most jurisdictions treat cryptocurrencies as property or commodities, not currency.

Understanding how your jurisdiction classifies crypto assets is crucial for compliance. What's considered legal in one country may be heavily restricted or banned in another.

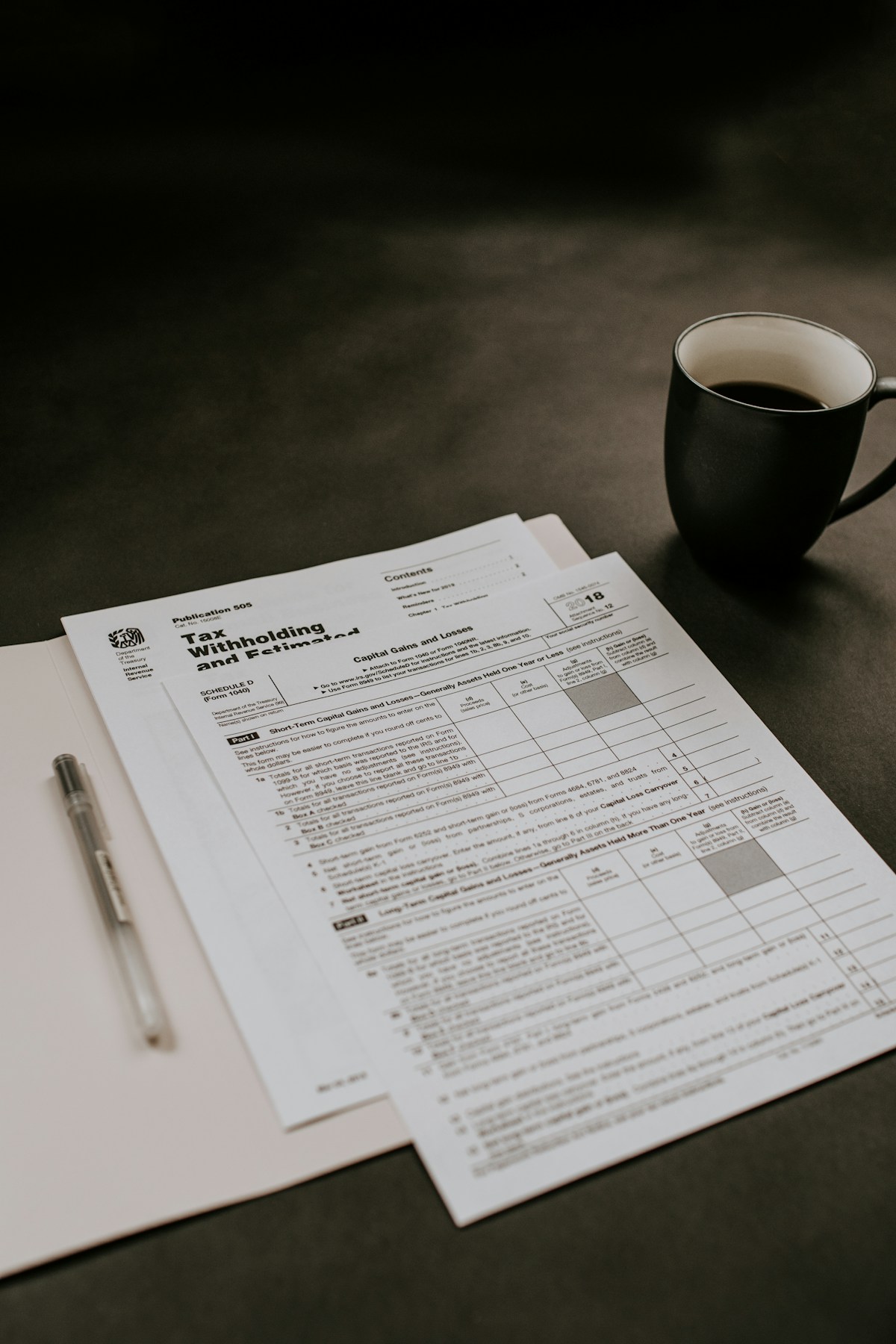

Tax Obligations for Crypto Investors

Cryptocurrencies typically trigger specific tax obligations:

- Capital Gains: Most jurisdictions treat cryptocurrency as property for tax purposes, meaning profits from sales are subject to capital gains tax.

- Income Tax: Mining rewards, staking yields, and payment for services in cryptocurrency may be subject to income tax.

- Tracking Responsibility: Investors must maintain detailed records of every transaction, including dates, values in fiat currency, and the nature of each transaction.

- Reporting Requirements: Many countries have implemented specific reporting requirements for cryptocurrency holdings and transactions.

Tax authorities worldwide have increased their focus on cryptocurrency compliance. The IRS in the United States, for example, now directly asks taxpayers about cryptocurrency activity on tax returns.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

AML/KYC regulations significantly impact how investors can buy, sell, and transfer cryptocurrencies:

- Identity Verification: Most legitimate exchanges require identity verification to comply with regulations.

- Transaction Monitoring: Large transactions may trigger reporting requirements or temporary holds.

- Travel Rule: Increasingly, information about the sender and recipient must accompany cryptocurrency transfers above certain thresholds.

While some investors are drawn to cryptocurrency for privacy reasons, fully anonymous transactions are becoming increasingly difficult on compliant platforms.

Smart Contract and DeFi Legal Risks

Decentralized Finance (DeFi) presents unique legal challenges:

- Code as Law: Smart contracts execute automatically, but may not account for all legal nuances or exceptions.

- Jurisdictional Questions: With no central authority, determining which jurisdiction's laws apply to a DeFi transaction can be complex.

- Liability for Failures: When smart contracts have vulnerabilities or fail, determining liability is often unclear.

- Licensing Requirements: Many DeFi activities may require financial licenses that decentralized protocols cannot easily obtain.

The legal framework around DeFi remains particularly underdeveloped, creating significant regulatory uncertainty.

Legal Protection of Crypto Assets

Securing legal protection for your cryptocurrency investments requires careful planning:

- Custody Solutions: Consider the legal implications of self-custody versus using regulated custodial services.

- Insurance Coverage: Traditional insurance may not cover cryptocurrency losses; specialized coverage might be necessary.

- Estate Planning: Include specific provisions for cryptocurrency assets in wills and trusts, including secure methods for heirs to access private keys.

- Documentation: Maintain clear documentation of ownership, particularly for jointly held assets.

Legal remedies for cryptocurrency theft or fraud can be limited, making preventative measures especially important.

International Considerations

The global nature of cryptocurrency introduces additional complexities:

- Cross-border Regulations: Transfers across borders may trigger reporting requirements or restrictions.

- Foreign Account Reporting: Cryptocurrency held on foreign exchanges may need to be reported on foreign financial account disclosures.

- Regulatory Arbitrage: While some investors seek jurisdictions with favorable regulations, this approach can create legal vulnerabilities.

Future Regulatory Developments

The regulatory landscape for cryptocurrencies continues to evolve:

- Increasing Oversight: Most jurisdictions are moving toward greater regulation of cryptocurrency markets.

- Specialized Frameworks: Some jurisdictions are developing crypto-specific regulatory frameworks rather than applying existing financial regulations.

- International Coordination: Efforts to coordinate regulation internationally are gaining momentum.

Staying informed about regulatory changes in relevant jurisdictions is essential for cryptocurrency investors. Consider consulting with legal professionals specializing in blockchain technology and digital assets to navigate the complex and changing landscape effectively.

By understanding and addressing these legal considerations, cryptocurrency investors can better protect themselves while participating in this innovative asset class. The goal isn't just to comply with current regulations, but to anticipate how evolving legal frameworks may impact investment strategies in the future.