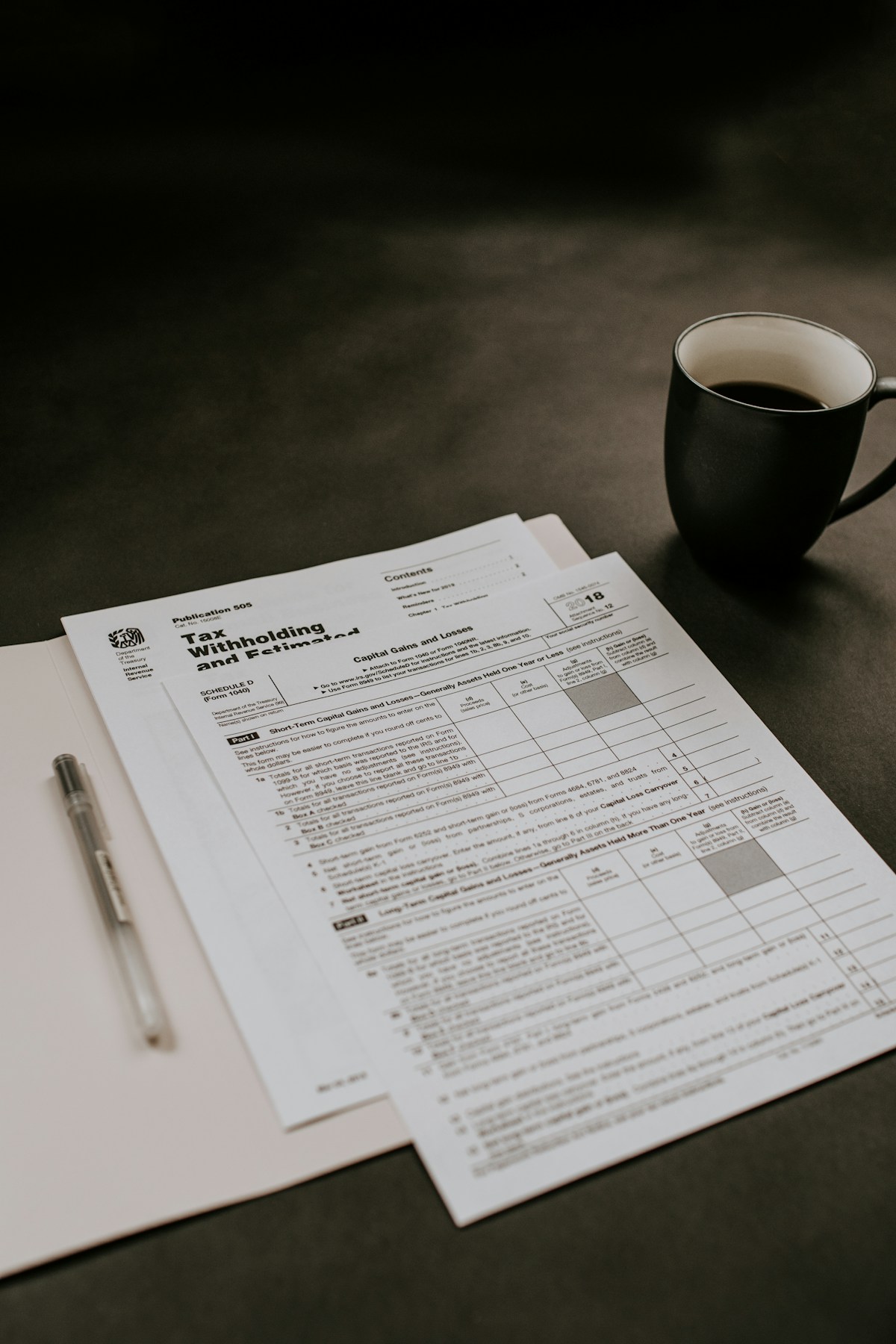

In an age of complex transactions, fine print, and powerful corporations, consumers often feel at a disadvantage when problems arise. However, you have more legal protections than you might realize. Various federal and state laws provide significant rights that most people never invoke—simply because they don't know these protections exist.

Here are eight powerful consumer protection laws that could save you thousands of dollars, protect your credit score, or help you resolve disputes in your favor.

1. The Fair Credit Billing Act: Your Secret Weapon Against Billing Errors

Most consumers have experienced frustrating billing errors: duplicate charges, incorrect amounts, or charges for items never received. What many don't realize is that federal law provides robust protections in these situations.

"The Fair Credit Billing Act is one of the most powerful but underutilized consumer laws," explains consumer rights attorney Melissa Greenfield. "It essentially gives consumers a legal mechanism to force creditors to investigate and correct billing errors."

This law enables you to:

- Dispute billing errors on credit cards, store cards, and revolving charge accounts

- Withhold payment on the disputed amount while the creditor investigates

- Require the creditor to acknowledge your dispute within 30 days

- Force the creditor to resolve the investigation within two billing cycles (but no more than 90 days)

- Remove the charge and any related interest or fees if the creditor can't prove it's legitimate

"The law even prohibits creditors from reporting the disputed amount as delinquent to credit bureaus during the investigation period," adds Greenfield. "And if they violate these requirements, consumers can sue for actual damages plus twice the finance charge, up to $5,000."

To invoke your FCBA rights, you must send a written dispute letter to the creditor's billing inquiries address (not the payment address) within 60 days of the first bill containing the error. The Consumer Financial Protection Bureau provides sample dispute letters on its website.

2. The Cooling-Off Rule: Your Right to Change Your Mind

Have you ever felt pressured into making a purchase decision you later regretted? In certain situations, federal law gives you the right to cancel without penalty—even if the seller's policy states "all sales are final."

"Many consumers don't realize they have an absolute right to cancel certain types of contracts within a specific timeframe," notes consumer protection expert James Martinez. "The FTC's Cooling-Off Rule is designed specifically to protect people from high-pressure sales tactics."

This federal protection applies to:

- Sales of $25 or more made at your home, workplace, or temporary selling location like a hotel room, convention center, or restaurant

- Sales made at a seller's temporary location, like a fair, hotel or motel room, convention center, or restaurant

For qualifying transactions, you have until midnight of the third business day to cancel for any reason. The seller must inform you of this right at the time of sale, provide cancellation forms, and return your payment within 10 days of receiving your cancellation notice.

"What's particularly valuable about this rule is that it applies even when the seller doesn't tell you about it," Martinez points out. "If they fail to provide the required cancellation forms or properly disclose your rights, the three-day window doesn't even start until they do."

In addition to the federal cooling-off rule, many states have enacted their own cancellation rights for specific types of contracts, including:

- Gym memberships (30-day cancellation rights in many states)

- Timeshare purchases (7-15 days in most states)

- Home improvement contracts (3 business days in several states)

- Dating services (3-7 days in states with specific laws)

"Always check your state's specific consumer protection laws when entering these types of agreements," advises Martinez. "The cancellation rights are often much broader than people realize."

3. The Fair Debt Collection Practices Act: Reining in Abusive Collectors

Dealing with debt collectors can be intimidating and stressful. However, the Fair Debt Collection Practices Act (FDCPA) places strict limits on what collectors can do—protections that extend far beyond the obvious prohibition of threats or harassment.

"The FDCPA essentially creates a consumer bill of rights in the debt collection context," explains consumer finance attorney David Wilson. "Most people are surprised to learn how many common collection tactics are actually illegal."

Under this powerful law, debt collectors cannot:

- Call before 8 a.m. or after 9 p.m. without your permission

- Contact you at work if you tell them verbally or in writing that your employer prohibits such calls

- Contact third parties (except your attorney) about your debt—they can only contact others to locate you, and even then with significant limitations

- Continue contacting you after you send a written request to stop (except to confirm they'll stop or to notify you of a specific action)

- Misrepresent the amount you owe or the legal status of the debt

- Threaten actions they don't intend to take or legally cannot take

- Use obscene language or any language intended to abuse, harass or intimidate

- Publish your name as someone who doesn't pay debts (except to credit bureaus)

- Seek collection of additional fees, interest, or expenses not authorized in the original agreement or by law

"One of the most valuable but underused provisions is the debt validation right," Wilson notes. "If you request debt validation within 30 days of first contact, the collector must stop all collection efforts until they provide verification of the debt."

Collectors who violate the FDCPA can be liable for actual damages, additional damages up to $1,000, and attorney's fees and costs. This fee-shifting provision often makes it possible to find attorneys willing to take these cases without upfront payment.

4. The Magnuson-Moss Warranty Act: Enforcing Warranty Promises

When products fail despite warranties, consumers often face resistance from manufacturers and retailers. Many don't realize that a specific federal law—the Magnuson-Moss Warranty Act—provides substantial leverage in these situations.

"Companies count on consumers not knowing their warranty rights," says consumer advocate Sarah Jenkins. "Many warranty disputes that companies initially refuse to honor are actually clear violations of federal law."

This important legislation:

- Requires warrantors to provide detailed information about warranty coverage in simple, understandable language

- Prohibits "conditional warranties" that require you to use specific items or services to maintain your warranty (with limited exceptions)

- Makes it easier to enforce warranties through streamlined legal procedures

- Allows consumers who prevail in warranty disputes to recover attorney's fees

"The prohibition on conditioning warranties is particularly valuable," Jenkins explains. "Despite what many businesses claim, using third-party parts or independent repair services generally cannot void your warranty unless the warrantor proves those parts or services caused the specific problem at issue."

This is why those "warranty void if removed" stickers on electronics are generally unenforceable, and why car manufacturers cannot void your warranty simply because you got oil changes at an independent shop.

"The attorney fee provision is also crucial," adds Jenkins. "It means that even for relatively small warranty claims, consumers can often find legal representation, since the manufacturer will have to pay the legal fees if the consumer prevails."

5. The Credit Card Accountability Responsibility and Disclosure Act: Credit Card Bill of Rights

Credit cards are governed by numerous regulations, but the CARD Act of 2009 implemented sweeping reforms that many cardholders don't fully appreciate or utilize.

"The CARD Act fundamentally changed the credit card landscape by eliminating many predatory practices," explains financial educator Elena Ramirez. "Yet most consumers aren't aware of the specific protections it provides."

Key provisions include:

- 45-day advance notice of significant changes to card terms (up from 15 days previously)

- The right to opt out of certain changes by closing your account and paying off the balance under the original terms

- Limitations on interest rate increases on existing balances

- Restrictions on over-limit fees (card issuers must get your opt-in before charging these fees)

- Requirements that payments above the minimum be applied to the highest-interest balance first

- Prohibition of multiple penalty fees for a single late payment

- A ban on "double-cycle billing" that calculated interest based on previous months' balances

"One provision with significant financial impact is the requirement that card statements show how long it will take to pay off your balance if you make only minimum payments," Ramirez notes. "Studies show this disclosure alone has prompted many consumers to increase their payment amounts, potentially saving them thousands in interest."

Understanding these protections allows consumers to spot violations and hold credit card companies accountable. If you believe your rights under the CARD Act have been violated, you can file complaints with the Consumer Financial Protection Bureau, which has enforcement authority.

6. The Real Estate Settlement Procedures Act: Mortgage Protections Most Homeowners Never Use

For most people, a home mortgage is the largest financial transaction they'll ever make. The Real Estate Settlement Procedures Act (RESPA) provides critical protections in this context, yet most homeowners never invoke them.

"RESPA is one of the most underutilized consumer protection laws relative to its potential value," says real estate attorney Thomas Blackwell. "It provides powerful mechanisms to address mortgage servicing issues, but most borrowers aren't aware of these rights."

While RESPA is best known for requiring disclosure of closing costs, its ongoing protections for existing mortgages are equally important:

- The right to send "Qualified Written Requests" (QWRs) that your servicer must acknowledge within 5 days and substantively respond to within 30 business days

- The right to send "Notice of Error" letters requiring your servicer to investigate and correct errors in your account

- The right to send "Request for Information" letters requiring your servicer to provide specific information about your loan

- Protection from "force-placed insurance" with specific notice requirements before a servicer can charge you for insurance they purchase

- Requirements that servicers promptly credit payments and provide payoff statements

"The Qualified Written Request process is particularly valuable when dealing with persistent servicing problems," Blackwell explains. "It creates a paper trail, imposes legal response deadlines, and can be the foundation for legal action if the servicer fails to properly address the issues."

Importantly, RESPA prohibits mortgage servicers from reporting negative information to credit bureaus for 60 days after receiving a QWR relating to a dispute. Servicers who violate RESPA's requirements can be liable for actual damages, additional damages up to $2,000 for a pattern of noncompliance, and attorney's fees.

7. The Electronic Fund Transfer Act: Debit Card Fraud Protection You Didn't Know You Had

While most consumers know credit cards offer fraud protection, fewer understand that debit cards also have federal protections through the Electronic Fund Transfer Act (EFTA)—though with important differences and limitations.

"The EFTA is the debit card equivalent to credit card protections, but the rules are more complex and time-sensitive," explains banking compliance officer Michael Chen. "Most consumers don't realize that their liability for fraudulent transactions depends entirely on how quickly they report the issue."

This law establishes a tiered liability structure:

- If you report a lost/stolen debit card before any unauthorized transactions occur: $0 liability

- If you report within 2 business days of learning about loss/theft: $50 maximum liability

- If you report more than 2 business days but within 60 calendar days after your statement is sent: $500 maximum liability

- If you report more than 60 calendar days after your statement is sent: Potentially unlimited liability for transactions after the 60-day period

"The good news is that many banks voluntarily implement more generous protections than the law requires," Chen notes. "Many offer 'zero liability' policies similar to credit cards, but these are voluntary programs that can have exceptions, so knowing your legal rights is still essential."

The EFTA also gives you the right to dispute errors in your account, and banks must investigate and respond to these disputes within specific timeframes. If the bank takes longer than 10 business days to resolve an error dispute, they generally must provisionally credit your account while the investigation continues.

8. The Telephone Consumer Protection Act: Turning Unwanted Calls Into Cash

Annoying robocalls and telemarketing calls are more than just nuisances—they may actually represent opportunities for compensation under the Telephone Consumer Protection Act (TCPA).

"The TCPA is unique among consumer protection laws because it provides substantial statutory damages without requiring proof of actual harm," explains telecommunications attorney Rebecca Gonzalez. "In essence, the law creates a private right of action with meaningful financial penalties that individual consumers can enforce."

This powerful law:

- Prohibits calls to cell phones using automatic telephone dialing systems or prerecorded voice messages without prior express consent

- Prohibits telemarketing calls to numbers on the National Do Not Call Registry

- Restricts telemarketing calls to residential lines outside the hours of 8 a.m. to 9 p.m.

- Requires telemarketers to maintain company-specific do-not-call lists and honor consumer requests to be added to these lists

- Requires identification of the caller and business at the beginning of the call

"What makes the TCPA particularly powerful is the statutory damage amount," Gonzalez emphasizes. "Violations can be worth $500 per call, and if the violation is deemed willful, that amount can be trebled to $1,500 per call."

For consumers who document repeated violations, this can add up quickly. "I've represented clients who received settlements in the thousands or tens of thousands of dollars for persistent violations," Gonzalez notes. "And while companies often try to claim they had consent or that their systems don't qualify as automatic dialers, courts have frequently rejected these defenses."

To maximize your TCPA rights, experts recommend:

- Registering your numbers on the National Do Not Call Registry (donotcall.gov)

- Documenting all unwanted calls with date, time, phone number, and company name if available

- Explicitly telling telemarketers to place you on their do-not-call list

- Saving voicemails from automated calls as evidence

- Consulting with a consumer protection attorney if you receive repeated violations

Knowledge Is Power: Using These Laws Effectively

Knowing your rights under these consumer protection laws is only the first step. Using them effectively requires understanding some important principles.

"Documentation is absolutely critical in consumer protection cases," advises attorney Greenfield. "Courts and regulatory agencies rely heavily on written evidence, so document everything—keep records of all communications, take screenshots, and put important disputes in writing even if you've also discussed them verbally."

Other key strategies include:

- Act promptly. Many of these laws have strict time limits for asserting your rights.

- Be specific. When invoking these protections, cite the specific law and section that applies to your situation.

- Communicate in writing. While phone calls may be more convenient, written communication (including email) creates a record and often triggers specific legal protections.

- Follow required procedures. Each law has specific requirements for how to assert your rights—follow them carefully.

- Know when to seek help. For significant disputes, consider consulting with a consumer protection attorney. Many offer free consultations, and several of these laws include provisions for recovery of attorney's fees if you prevail.

"One pattern I've observed is that simply demonstrating knowledge of these laws often leads to faster resolution," notes Chen. "When companies realize you understand your legal rights and the potential consequences of violations, they're frequently more willing to resolve disputes favorably."

Consumer protection laws exist to balance the inherent power differential between individual consumers and businesses. By understanding and assertively using these legal protections, you can transform from a potentially vulnerable consumer to an empowered one who knows exactly how to navigate problems when they arise.

As Martinez concludes: "These laws only work when consumers know about them and use them. They represent powerful tools that can save you money, protect your credit score, and help you resolve disputes that might otherwise seem hopeless."